The Art of Seamless Payment: Unveiling the World involving Merchant Services

Welcome to typically the dynamic world of merchant services, where businesses of most shapes and dimensions utilize innovative options to streamline deals and enhance customer experiences. From little local retailers to be able to e-commerce giants, retailers rely on a range of services to firmly process payments plus manage financial transactions efficiently. In this particular fast-paced digital period, the ability of seamless repayment has become a cornerstone of success, prompting companies to embrace witty technologies and superior tools to keep competitive and secure their operations. Amongst this landscape, Merchant Protection stands while a beacon regarding assurance, offering shielding mechanisms and methods to shield retailers from fraudulent pursuits and unforeseen dangers, ensuring smooth and even secure transactions with regard to both sellers in addition to buyers alike.

Understanding Vendor Services

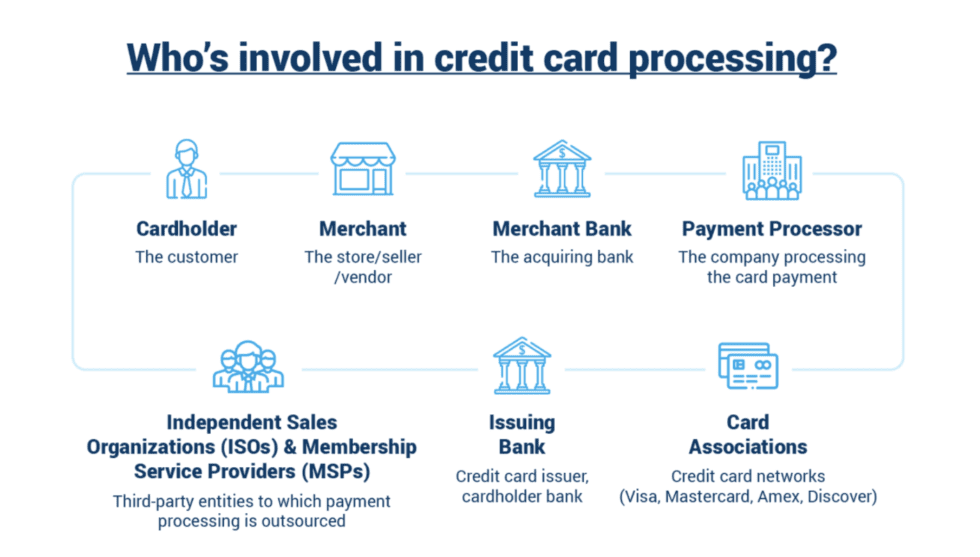

Merchant services carry out a pivotal part in today's organization landscape, enabling vendors to simply accept various kinds of payment. These services encompass some sort of range of alternatives that allow businesses to process transactions efficiently and securely. Be it accepting credit rating card payments in-store or facilitating on-line transactions, merchant solutions provide the essential infrastructure for soft payment processing.

Merchants depend on these services to improve the overall consumer experience by giving diverse payment alternatives. Merchant services certainly not only ensure comfort for customers although also help with developing trust and loyalty. By providing a smooth and hassle-free settlement experience, businesses can easily attract and maintain customers, ultimately traveling revenue growth in addition to fostering long-term interactions.

One crucial aspect of merchant services will be Merchant Protection, which usually safeguards businesses from fraudulent activities in addition to chargebacks. With typically the ever-evolving landscape of cyber threats in addition to payment fraud, having robust Merchant Security measures in place is fundamental for mitigating hazards. By prioritizing protection and fraud avoidance, merchants can function with confidence, understanding that their transactions are generally secure and their own interests are guarded.

Significance of Merchant Security

Making sure the safeguarding associated with transactions and sensitive customer information will be paramount in the world of merchant services. Merchant Protection offers reassurance to be able to merchants by mitigating risks associated with deceptive activities and chargebacks. By implementing strong security measures, vendors can build trust with their buyers and protect their very own reputation in the marketplace.

Merchant Protection also plays an essential function in reducing economic losses for your business. Using the rise of online transactions, the opportunity of fraud has increased significantly. However, using the right Merchant Protection services in place, merchants can find and prevent deceptive activities, ultimately minimizing financial impact plus preserving profitability.

Moreover, Service provider Protection fosters some sort of secure environment intended for both merchants in addition to customers to employ in transactions. Simply by prioritizing data protection and fraud avoidance, merchants can create a seamless payment experience of which instills confidence and encourages repeat enterprise. https://redfynn.com/partner/ on security not only benefits the merchants by themselves but also contributes to overall have confidence in and credibility inside the industry.

Maximizing Repayment Efficiency

One crucial aspect for merchants to consider when utilizing merchant services is enhancing payment efficiency. Rationalization the payment process not just enhances consumer satisfaction but additionally contributes to increased revenue and revenue. Simply by implementing secure in addition to user-friendly payment solutions, merchants can make easier transactions and decrease friction points with regard to customers.

Embracing digital settlement options such because mobile wallets in addition to contactless payments can easily significantly enhance transaction efficiency. These cutting edge technologies offer easy and swift transaction experiences, attracting tech-savvy customers and traffic up the peruse process. In addition , making use of online payment gateways and POS devices can facilitate seamless transactions, allowing merchants to cater to several payment preferences and even methods.

Moreover, leveraging files analytics and credit reporting tools offered by product owner service providers will help merchants gain handy insights into customer behavior and payment trends. By inspecting transaction data and customer feedback, vendors can identify revenue patterns, optimize charges strategies, and change their offerings in order to meet customers' needs effectively. This data-driven approach not merely improves payment efficiency nevertheless also fosters extensive customer loyalty and business growth.